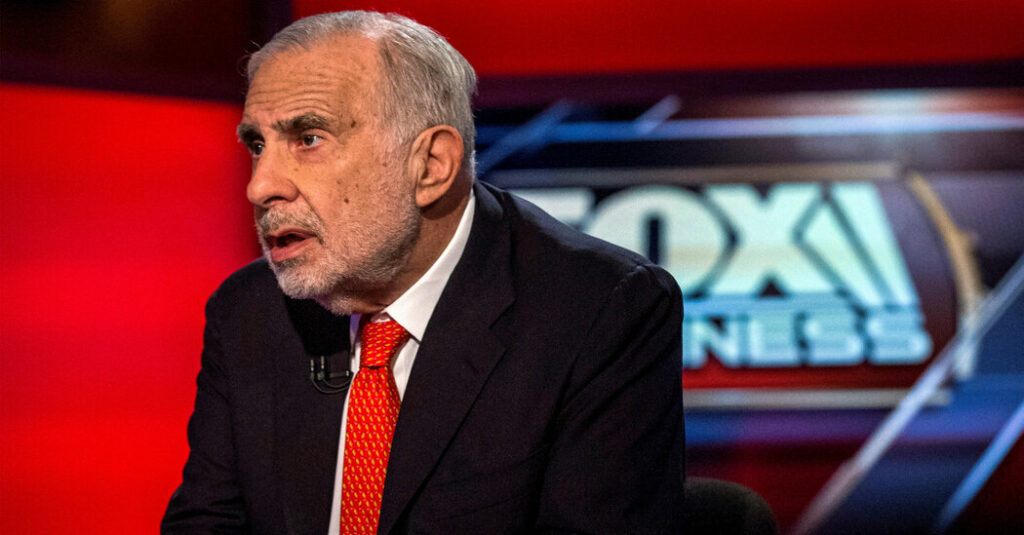

Carl Icahn’s Battle with Illumina Comes to a Head

9 min read

Is Icahn on the cusp of a big win?

One of the biggest fights in corporate America is coming to a head on Thursday: Shareholders in Illumina, the gene-sequencing giant, are set to vote on whether to back the company’s incumbent directors or candidates nominated by the billionaire Carl Icahn.

A board fight involving one of Wall Street’s top activist investors is significant in its own right. But there’s more at play here, including a takeover that has tested antitrust regulators on both sides of the Atlantic and new proxy rules that could reshape American corporate governance.

A $7 billion deal for Grail is a major factor in this scuffle. Mr. Icahn has criticized Illumina’s effort to close its takeover of the cancer-detection company, despite European antitrust authorities’ decision to block the deal, and opposition from the F.T.C. He calls it “inexplicable and unforgivable.” Other shareholders may agree, given that Illumina has lost $50 billion in market value since announcing the deal in August 2021.

Illumina has dismissed the European objection, arguing that Grail has no revenue or operations in Europe. It’s part of broader pushback against global antitrust regulators’ more ambitious, and often coordinated, efforts to rein in big-ticket M.&A.

The contest is also a test of universal proxy, a new S.E.C. rule that makes it easier for shareholders to vote for board candidates from different slates. Mr. Icahn has put up three nominees, challenging incumbent directors including Illumina’s C.E.O., Francis deSouza, and chairman, John Thompson. (He has argued that the two are too close.)

Mr. Icahn could very well win a seat. Influential shareholder advisory firms have offered the campaign some support. Institutional Shareholder Services backed an Icahn candidate, Andrew Teno, over Mr. Thompson, arguing that a more independent chair would have offered a better counterbalance “as the company navigated certain controversial decisions by management.” And Glass Lewis backed two Icahn nominees over Mr. Thompson and Mr. deSouza.

That may be enough to ensure that at least one of Icahn’s candidates, probably Mr. Teno, wins on Thursday. (Illumina had offered Mr. Icahn a board seat as part of initial settlement efforts, which the activist investor rejected.)

But Mr. Icahn himself still faces pressure elsewhere. The billionaire is battling the short seller Hindenburg Research, which has argued that Mr. Icahn’s publicly traded investment vehicle is overvalued and funds its dividends by selling new shares. (A former Icahn foe, Bill Ackman, again weighed in on the fight on Wednesday, suggesting shares in Mr. Icahn’s firm could fall yet more.)

Mr. Icahn has dismissed Hindenburg’s accusations as a “disinformation campaign” — but his company is now facing government scrutiny, and its shares have fallen by more than 50 percent over the past month.

HERE’S WHAT’S HAPPENING

TikTok is found to have freely shared user data internally. Employees at the video app routinely posted sensitive information like identity data and photos on an internal messaging tool visible to its Chinese parent company, ByteDance, The Times’s Sapna Maheshwari and Ryan Mac report. The revelation may pose another headache for TikTok as it faces scrutiny in Washington and a ban in Montana.

Fitch warns it may downgrade the United States’ debt. The ratings agency put the national AAA rating on negative watch, as a political impasse on raising the debt ceiling makes a default more likely. JPMorgan Chase’s chief U.S. economist has put the odds of the dispute going past the so-called X-date, the point at which the government runs out of cash, at 25 percent.

Fed officials aren’t sure whether to keep raising rates. Minutes from the central bank’s last rate-setting meeting showed division on whether higher interest rates were needed to tamp down inflation. That may signal a more dovish turn to investors as they prepare for the Fed’s next rates meeting in mid-June.

Shareholder advisers recommend ousting Alphabet’s chair. The proxy advisory firms Institutional Shareholder Services and Glass Lewis suggest that investors oust two directors of Google’s parent company, including its chair, John Hennessy. There have been several pushes to revamp Alphabet’s corporate governance, but it’s unclear whether shareholders will get on board.

Chinese-backed hackers infiltrated critical U.S. infrastructure, Microsoft warns. A state-sponsored group has been working since 2021 to disrupt “critical communications infrastructure between the United States and Asia,” the tech giant said on Wednesday. U.S. officials are worried the intrusion is meant to hurt American efforts to aid Taiwan in the event of a Chinese attack.

Twitter fumbles its big political moment

Hosting Ron DeSantis’s official presidential campaign announcement was supposed to be a triumph for Twitter, as Elon Musk seeks to make the social network a major player in politics and the media. But the live audio event was marred by over 20 minutes of technical glitches, costing it more than half of its initial audience. (“That was insane, sorry,” Mr. Musk later said.)

The mishap again raises questions about Twitter’s systems, as it seeks to woo advertisers again and fulfill Mr. Musk’s ambitious vision.

Twitter employees had feared a misfire, The Times’s Ryan Mac reports: There had been no planning for “site reliability issues,” leaving workers to scramble when the influx of more than 600,000 listeners crashed Twitter’s systems.

Questions about the reliability of Twitter’s infrastructure have dogged the company for months, ever since Mr. Musk initiated an enormous wave of layoffs, including of backend engineers, and closed a data center. The site suffered at least four outages in February, compared with nine in all of 2022.

None of this is likely to sit well with advertisers, many of whom have shied away from Twitter since Mr. Musk’s takeover over concerns about content moderation and more. Some are tentatively looking to return, especially with the appointment of the former NBCUniversal ad chief Linda Yaccarino as C.E.O. — but the renewed questions about reliability provide another reason to keep some distance.

A.I. sends Nvidia’s stock skyward

Shares in Nvidia set a record in premarket trading on Thursday, after the chip maker delivered a knockout sales outlook powered by demand for the processors that run artificial intelligence systems.

“We’re seeing incredible orders to retool the world’s data centers,” Jensen Huang, Nvidia’s C.E.O., told analysts on Wednesday. (His company’s G.P.U. chips are used to power A.I. systems; they previously enjoyed huge demand during the boom in crypto, whose systems also rely on their processing power.) Nvidia’s market cap hit $755 billion at Wednesday’s market close, the fifth highest public valuation in the U.S.

The A.I. rally has lifted other chip stocks as well, including AMD, ASML and Taiwan Semiconductor Manufacturing Company.

But analysts disagree on how long the rally will last. Michael Hartnett of Bank of America called the rises a “baby bubble.” On the other hand, researchers at Goldman Sachs said tools built on generative A.I. could help bolster worldwide G.D.P. by $7 trillion.

In other A.I. news:

Reid Hoffman, the billionaire LinkedIn co-founder, has emerged as one of Silicon Valley’s biggest A.I. evangelists and deal makers.

After meeting with top European Union officials on Wednesday, Sundar Pichai, the C.E.O. of Alphabet, promised that Google would work with others to develop A.I. services responsibly.

Starting in July, New York City will require companies that use A.I. for job recruitment to inform the candidates, under a new law that is being closely watched by labor rights advocates.

“This is what a recession looks like. There used to be 20 of these.”

— An unnamed guest quoted by The Wall Street Journal at a star-filled party co-hosted by David Zaslav of Warner Bros. Discovery and the editor Graydon Carter, referring to two giant yachts anchored near Cannes in France.

JPMorgan fires back in Epstein case

JPMorgan Chase has gone on the counteroffensive in a looming civil case that pits victims of the sex offender Jeffrey Epstein against the Wall Street giant.

Prosecutors in the U.S. Virgin Islands accuse JPMorgan of helping Mr. Epstein, a financier and longtime client of the bank who died in 2019, traffic and sexually exploit women and young girls. In a legal motion filed on Wednesday in a federal court in Manhattan, the bank said that government officials from the islands had helped Mr. Epstein commit the crimes.

“In exchange for Epstein’s cash and gifts, U.S.V.I. made life easy for him,” JPMorgan’s lawyers wrote in the motion. The government, they said, “made sure that no one asked too many questions about his transport and keeping of young girls on his island.” The bank accused island officials of engaging in a “decades-long quid pro quo” with Mr. Epstein, taking favors and political donations and granting him millions in tax incentives all while “fostering the perfect conditions for Mr. Epstein’s criminal conduct to continue undetected.”

JPMorgan wants the court’s permission to dig into the island government’s purported complicity, and to raise this as a defense at trial.

Big names in the case are set to be deposed in the coming days. A two-day deposition of Jamie Dimon, the bank’s C.E.O., is scheduled to begin on Friday. On June 6, it’s the turn of the U.S.V.I. governor, Albert Bryan Jr.

In a related case, Deutsche Bank last week agreed to a $75 million settlement with victims of Mr. Epstein who had accused the bank of helping him commit further crimes. David Boies, a lawyer for the victims, has been arguing that JPMorgan’s ties to Mr. Epstein were more extensive and lasting, raising the possibility that a resolution would be more costly.

Also attending Dimon’s deposition will be lawyers for Jes Staley. JPMorgan sued its former executive in March, arguing that his ties to Mr. Epstein are to blame for the bank’s tainted relations. Mr. Staley was just dealt a blow on Wednesday when the judge denied his efforts to have the case against him dismissed.

THE SPEED READ

Deals

Citigroup called off the sale of Banamex, its Mexican unit, and plans to instead take it public. (Reuters)

The digital media site Semafor raised $19 million from investors including Henry Kravis to replace money from Sam Bankman-Fried, the fallen crypto mogul. (NYT)

Credit Suisse abandoned efforts to protect over $400 million in executive bonuses from being blocked after the bank’s fire sale to UBS. (FT)

Policy

Representative George Santos, the New York Republican accused of fraud and money laundering, secured three anonymous guarantors for the $500,000 bond in his case. (Bloomberg)

Prosecutors are reportedly scrutinizing stock trades by First Republic employees during the lender’s implosion. (Bloomberg)

“Venture Capitalists Face Pressure to Divest From China.” (The Information)

Best of the rest

“More Airlines Are Encountering Near Collisions — and No One Knows Why.” (WSJ)

Tina Turner, whose explosive voice and charisma made her one of the most successful recording artists of all time, died on Wednesday. She was 83. (NYT)

Can reducing sheep burps help in the fight against climate change? (Semafor)

We’d like your feedback! Please email thoughts and suggestions to [email protected].

Andrew Ross Sorkin is a columnist and the founder and editor at large of DealBook. He is a co-anchor of CNBC’s “Squawk Box” and the author of “Too Big to Fail.” He is also a co-creator of the Showtime drama series “Billions.” @andrewrsorkin • Facebook

Bernhard Warner joined the The Times in 2022 as a senior editor for DealBook. Previously he was a senior writer and editor at Fortune focusing on business, the economy and the markets. @bernhardwarner

Sarah Kessler is a senior staff editor for DealBook and the author of “Gigged,” a book about workers in the gig economy. @sarahfkessler

Michael de la Merced joined The Times as a reporter in 2006, covering Wall Street and finance. Among his main coverage areas are mergers and acquisitions, bankruptcies and the private equity industry. @m_delamerced • Facebook

Lauren Hirsch joined The Times from CNBC in 2020, covering deals and the biggest stories on Wall Street. @laurenshirsch

Ephrat Livni reports from Washington on the intersection of business and policy for DealBook. Previously, she was a senior reporter at Quartz, covering law and politics, and has practiced law in the public and private sectors. @el72champs

Source: Read Full Article